- All

- About Hexa Prop

- Challenges

- Duplex

- Funded Accounts

- General Information

- Instant

- Platforms & Instruments

- Simplex

- Trading Rules

- Triplex

The rules have been designed to ensure that the limits and profit targets set are balanced and provide sufficient flexibility to manage risk and maintain positive cash flow.

If the trading targets are not met or a rule is violated during the assessment phase, the associated account will be automatically deactivated, and no further trading will be allowed. (Funded accounts are not subject to the Profit Target, but must adhere to Drawdown Limits and avoid Prohibited Activities.)

We believe in second chances, so we offer persistent traders the opportunity to go through the evaluation phase again and register a new account in the Customer Area.

We are a global community of traders, providing trading opportunities with a high level of technical sophistication and a safe environment for beginners, advanced and professional traders. Beginners and advanced traders can save a significant amount of money by not using their own capital during the learning period, while also helping experienced traders overcome financial constraints.

Innovation, payment transparency, fairness, and long-term cooperation are the cornerstones of our philosophy. We offer not only the traditional two-phase financing but also one-phase and three-phase evaluation processes. For those who prefer to skip the evaluation, our Instant Challenge is available. No matter which plan you choose, accounts can be scaled up to $10 million.

Hexa Prop is a prop trading company founded and run by an experienced and dedicated team.

As a first step, review the three evaluation models and our Instant Funding model, then choose the package that suits your trading style. To get started, you need to register, but registration alone does not obligate you to anything. Once registered, you can begin one of the challenges and select the account size and trading platform that best suits your needs. After submitting your application, you will receive your trading account number and login credentials, and you can begin the evaluation phase.

All the rules you need to follow can be found on the Challenge Rules & Prohibited Activities page.

No special qualifications are required. We welcome clients over 18 years old from all over the world, whether you are a beginner, advanced, or experienced trader. However, due to strict anti-money laundering (AML), counter-terrorist financing (CFT), and risk management guidelines, we do not accept clients from the following countries: Afghanistan, Cuba, Iran, North Korea, Myanmar, Russia (or the Crimean, Donetsk, or Luhansk regions of Ukraine), Somalia, and Syria.

Hexa Prop offers a wide range of tradable products. We offer trading opportunities for those with financial constraints or who prefer not to hold significant funds with a brokerage firm.

Our clients have a choice of three evaluation processes and one Instant Funding Program. We will refund the Challenge fee upon successful completion of the assessment processes, except for Instant Funding.

We provide our clients with three different trading platforms (two of them with Trading View) and also support their trading with educational materials.

After registration, you can immediately start a Challenge, where you must complete an evaluation process to become a Funded trader eligible to receive payouts. You can choose from three different assessment processes. In the first part of the process, select a package and start trading. Once you have reached the predefined profit target during the evaluation stages while complying with the rules, you can move on to the Funded stage after completing the identity check.

Want to skip the evaluation? With our Instant Funding Plan, you can start trading immediately—no challenges, no evaluation phase, just direct access to a funded account!

You will need to choose the Challenge (evaluation process) that best suits you (Simplex, Duplex, Triplex) or Instant Funding Program. After paying for the chosen package, you will be provided with a demo account that streams real financial market movements. In this account, you can trade with virtual (i.e., fictitious) capital, and if you reach the predefined profit target, you can move on to the next phase. This phase could be the Funded phase or another evaluation phase, depending on the number of tiered packages you’ve chosen.

Once you have successfully passed the assessment process, we will provide you with a Hexa Prop Funded account.

With the Hexa Prop Funded account, you will continue trading on a simulated demo account, meaning there is no real or margin account trading. However, the Hexa Prop Funded trader will receive real financial rewards as long as their trading is profitable and complies with the contractual terms. During the Funded stage, you can withdraw up to 100% of the profit earned on your virtual account in real money.

If you become Hexa Prop Funded Trader, we will refund 100% of your subscription fee that you previously paid. Simply reach out to us at hello@hexaprop.com, and you will receive your refund with your first payout.

With our Instant Funded Plan, there are no challenges. Simply choose your account size and start earning profits from day one.

If you don’t reach the Funded stage in the Duplex plan due to a hard breach, you will receive a coupon code for a FREE try. This allows you to restart completely free with a Duplex Double Bonus challenge account—matching the same initial balance as your original account.

If you are interested in what your Duplex Double Bonus rules will be, see here.

The Scaling Plan is the same as in the Duplex Challenge.

If you don’t reach the Funded stage in the Triplex plan due to a hard breach, you will receive a coupon code for a FREE try. This allows you to restart completely free with a Triplex Double Bonus challenge account—matching the same initial balance as your original account.

If you are interested in what your Triplex Double Bonus rules will be, see here.

The Scaling Plan is the same as in the Triplex Challenge.

We do not have any profit consistency rules for Instant, Simplex, Duplex, and Triplex accounts.

However, these rules apply to Duplex and Triplex BONUS accounts, which you received for free from Hexa Prop. You can learn more about the other rules here.

How does the 40% profit consistency rule work?

This rule means that no single trading day’s profit can equal or exceed 40% of the total profits earned during the payout period. If the profit from one trading day reaches or surpasses 40% of the total profits for that period, you cannot request a payout until your highest-profit trading day accounts for less than 40% of your total profits.

If a trader earns more than 40% of their total profit in a single day, their account will not be terminated for violating the 40% rule. However, they must continue trading and generate additional profits until their highest-profit day falls below the 40% threshold.

For example, if you earn $2,000 in a single trading day, you must reach at least $5,000 in total profits within that period before you can withdraw funds from your account.

A Hexa Prop Funded account is an account containing virtual funds that tracks and streams the price of real financial products with real market quotes from liquidity providers.

Our Technology Partner Companies

With Hexa Prop, you can trade without risking your own capital or making a deposit. We provide a professional environment and the credits you need to trade. We enable you to trade with large amounts of virtual capital and withdraw your virtual profits as real money.

You can get an account of up to $200,000, giving you the opportunity to maximize your potential in the market.

Mistakes and lack of discipline can be costly in trading, but we take the stress off our traders’ shoulders. The most you can lose is the registration fee, and no one is exposed to significant financial risk. Disciplined and compliant traders have great potential to achieve outstanding returns.

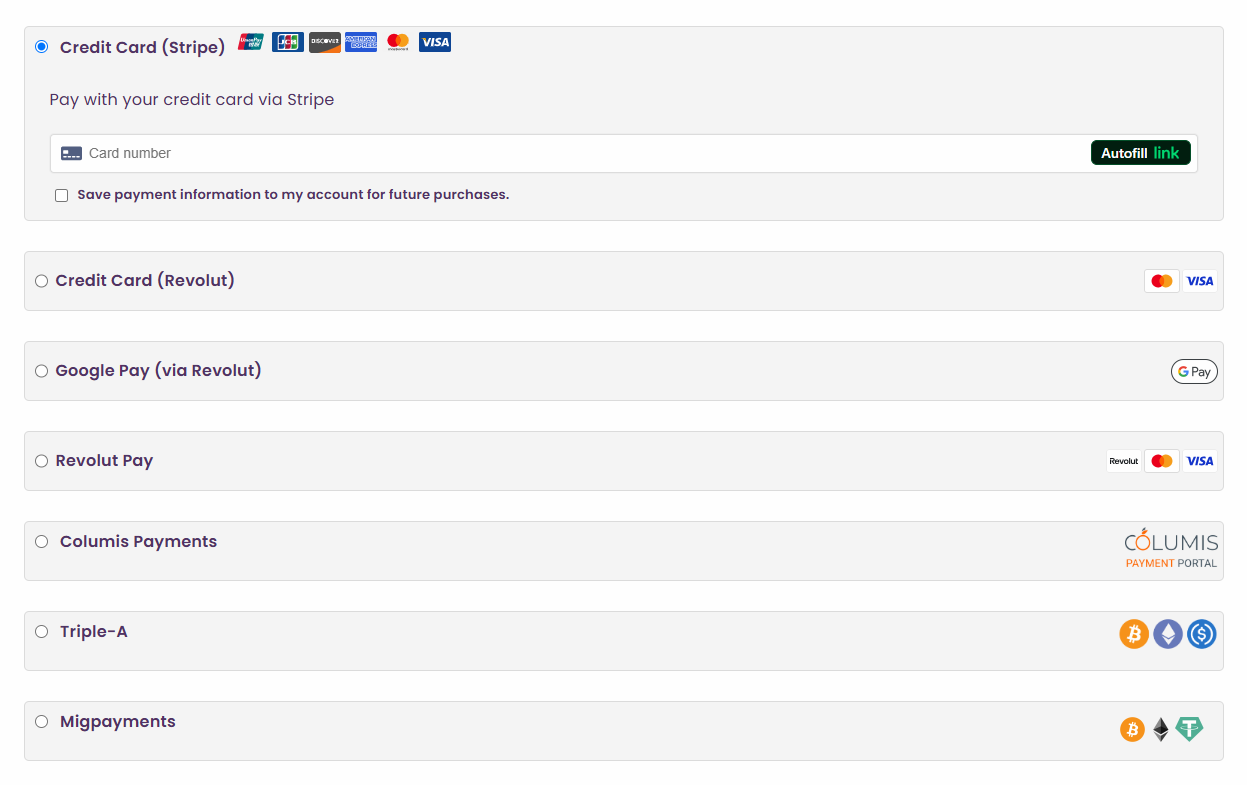

Hexa Prop offers a wide range of payment methods. We understand that different clients have varying preferences, so we provide multiple ways to make payments: Stripe credit/debit card, Revolut Pay, Google/Apple Pay, Triple A, digital currencies, Binance Pay, and Columis.

- 1

Register and open a Hexa Prop account.

- 2

On your account dashboard, go to the “Challenges” section and select the package and account size you’d like to purchase.

- 3

Complete the required purchase form. You’ll need to enter your personal information and accept our Policies (Terms & Conditions, Privacy Policy, Challenge Rules & Prohibited Activities). We recommend reading them carefully, especially the Challenge Rules & Prohibited Activities.

- 4

In the next step, you’ll have a choice of several payment methods, as shown in the image below. Select the one that is most convenient for you and complete the payment process.

Once payment is complete, your account will be processed immediately. With card and digital currency payments, you’ll receive your account credentials instantly, while verification for other payment methods may take a bit longer.

After successful account creation, you’ll receive a notification email. This email and your client dashboard panel will contain the login details for the trading platform. If you don’t see the email in your inbox, please check your spam/junk folder.

We strongly recommend securing your login credentials and not sharing them with anyone. It is important to protect your account information and maintain exclusive control over access.

Upon purchasing an Assessment, you will receive access to a trader dashboard where you can monitor your Assessment and Live Accounts. The dashboard is updated every time we calculate metrics, which occurs roughly every 60 seconds. It is your responsibility to monitor your breach levels.

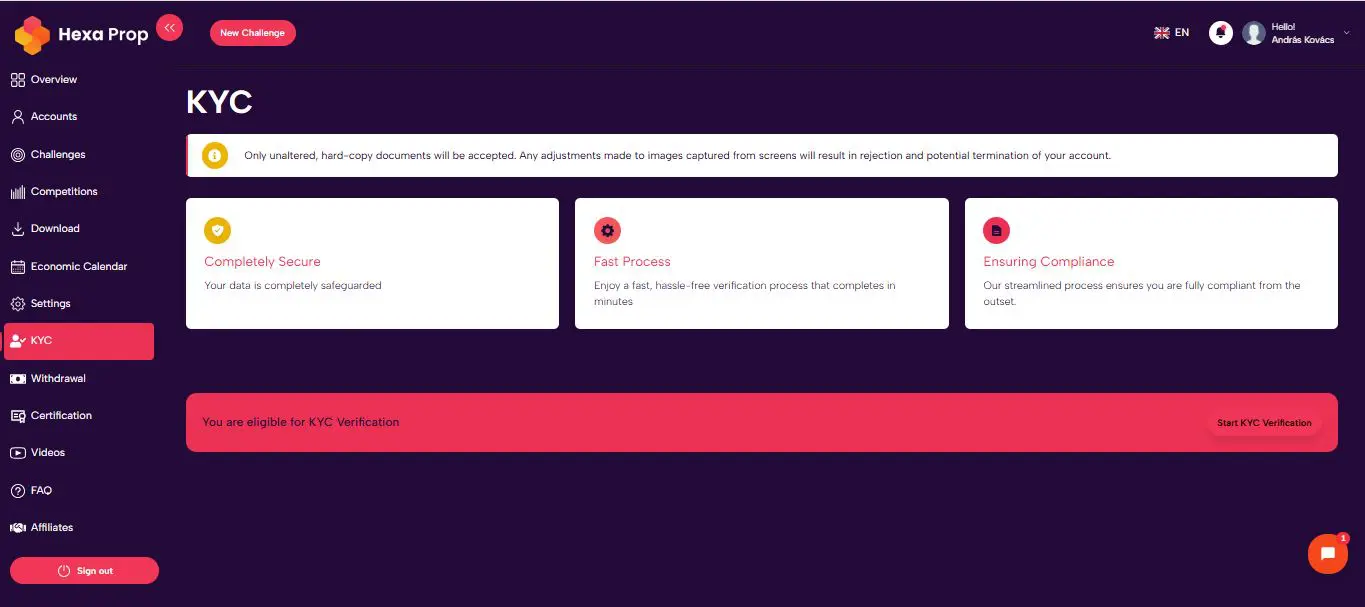

The withdrawal process can be initiated from the dashboard interface. The first profit withdrawal requires us to verify your identity during the KYC phase. This process takes only a few minutes. During the verification process, the microphone of the device being used (smartphone, computer) should not be disabled; otherwise, the identification will fail. The identity verification only needs to be completed once and will not be required for future withdrawals. After successful verification, the “Withdrawal” section will become active, allowing you to initiate a withdrawal request.

For withdrawals, our main partner is the Riseworks payment provider. Hexa Prop covers the withdrawal fees and does not pass this cost onto clients. This is why we have set a minimum withdrawal amount of $500, as this incurs a cost for our company.

You must complete one or more evaluation processes to become a Funded Trader eligible to receive payouts. You can choose from three different evaluation processes. As the first step, select a package and start trading! Once you have reached the profit target set in the evaluation stages and followed the rules, you can move on to the Funded stage – and also receive a 100% refund with the first payout. You can be our Funded Trader immediately, if you choose our Instant Funded Plan, and go through of our KYC process.

The rules have been designed to ensure that the limits and profit targets set are balanced and provide sufficient flexibility to manage risk and maintain positive cash flow.

If the trading targets are not met or a rule is violated during the assessment phase, the associated account will be automatically deactivated, and no further trading will be allowed. (Funded accounts are not subject to the Profit Target, but must adhere to Drawdown Limits and avoid Prohibited Activities.)

We believe in second chances, so we offer persistent traders the opportunity to go through the evaluation phase again and register a new account in the Customer Area.

There is no limit on the number of accounts in the assessment stages. However, in the Funded stage, we have a maximum capital allocation limit of 800,000 USD. These limits are necessary for risk mitigation and diversification.

Please do not open multiple accounts under different registrations, as this is not allowed. If we discover identical trading strategies in different accounts and the total value of active Hexa Prop Funded accounts exceeds $800,000, we reserve the right to suspend these accounts under the contract.

Our company strives to meet the needs of traders when it comes to trading platforms. We understand that different traders prefer different tools, and that’s why we currently offer four trading platforms, each designed to cater to diverse trading styles and preferences.

By offering these three platforms, we aim to ensure that every trader, regardless of their experience level or trading style, can find a platform that suits their needs and helps them succeed.

If you would like to view the trading platforms and spreads, you can log in to the accounts using the details below.

| Platform | Server | Login | Password | Download Platform |

|---|---|---|---|---|

| cTrader | ctid8781007 | support+hp@hexaprop.com | d6C^eHmtr#8 | Click here |

| Match-Trader | — | support@hexaprop.com | d6C^eHmtr#8 | Click here |

| DXtrade | — | hp_C0012065 | d6C^eHmtr#8 | Click here |

The broker currently pricing cTrader, Match-Trader & DX Trade is Zenfinex, who are using an aggregated mix of tier 1 banks, brokers & market makers to price their products. we are using yourbourse bridge to connect LP pricing to platforms.

cTrader

cTrader is a modern trading platform that caters to both manual and algorithmic trading needs. It offers a premium platform for Forex and CFD trading, featuring advanced charting tools and fast execution capabilities across various devices. Its user interface is connected to highly sophisticated backend technology and is available on desktop, web, and mobile devices.

cTrader Copy This feature allows users to become strategy providers, sharing their trading strategies for a commission. Other traders can copy the available strategies, customizing them with their own risk management settings.

cTrader Automate This all-inclusive algorithmic trading solution enables traders to automate their strategies using custom indicators and trading robots. Additionally, the cTrader Open API provides developers with the ability to create trading applications that integrate seamlessly with any cTrader account.

cTrader Web The web-based version of cTrader works with any browser, providing quick and easy access to all cTrader features from any popular browser. The platform is available without installation, offering access to cTrader for users on Windows, Mac, or Linux operating systems.

cTrader Mobile Native cTrader mobile apps are available for iOS and Android devices. Traders can download the native cTrader app from the App Store or Google Play Store to trade on the go with full functionality.

These features make cTrader a versatile and user-friendly platform suitable for both beginner and experienced traders.

Match-Trader

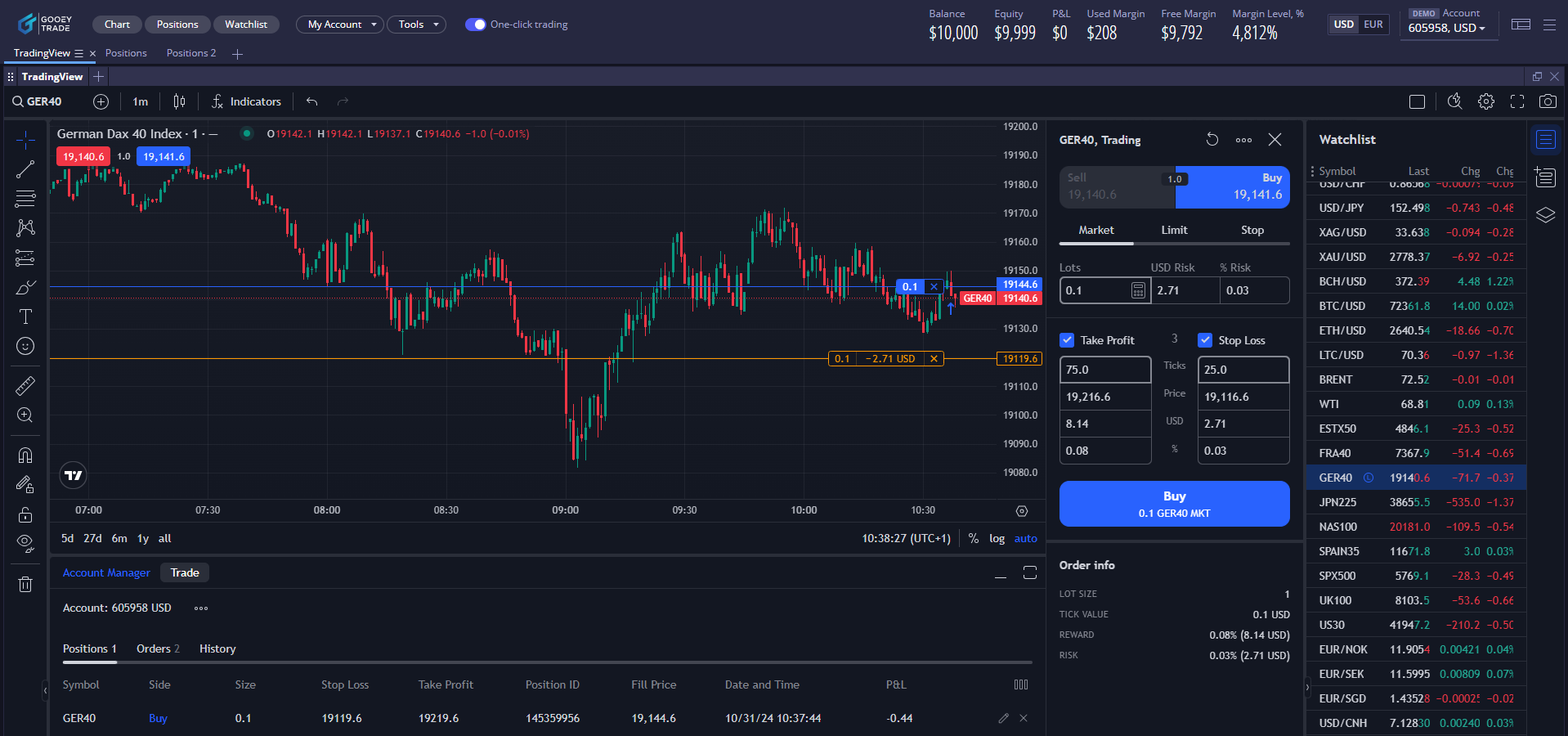

Match-Trader is an award-winning technology enhanced with TradingView charts.

With TradingView charts and an in-house FX and Prop CRM, Match-Trader offers a competitive edge over older platforms. The platform calculates risk based on the quantity provided by the trader. The charts are easily customizable, and traders can open multiple charts simultaneously, enhancing the trading experience.

Its design and features make it an optimal choice for traders looking for modern solutions with seamless access and advanced functionalities.

DXtrade

DXtrade is now integrated with TradingView, an advanced charting platform for financial market analysis. With interactive charts, an intuitive interface, and powerful tools like screeners and the economic data calendar, traders can efficiently analyze markets, spot trends, and make well-informed decisions.

DXtrade is a flexible and highly customisable application. It aims to provide retail and institutional traders with a competitive, modern and user-friendly trading experience. It offers many useful features, including advanced charting tools, risk management systems, order management and access to various financial instruments (Forex, Commodities, CFDs, digital currencies, etc.).

Yes, as long as you do not break the rules defined in the contract terms.

Yes, as long as you do not break the rules defined in the contract terms.

You can trade any products streamed by the Liquidity Provider into the available on your trading platform, including Forex and digital currencies, indices and commodities. The list of tradable symbols grouped by platform is provided below:

cTrader

| Symbols | Instruments |

|---|---|

| Forex (Spot) | EURUSD, GBPUSD, EURJPY, USDJPY, AUDUSD, USDCHF, GBPJPY, USDCAD, EURGBP, EURCHF, AUDJPY, NZDUSD, CHFJPY, EURAUD, CADJPY, GBPAUD, EURCAD, AUDCAD, AUDNZD, NZDJPY, USDNOK, AUDCHF, USDMXN, GBPNZD, EURNZD, CADCHF, USDSGD, USDSEK, NZDCAD, EURSEK, EURNOK, NZDCHF, GBPCHF, USDZAR, USDCNH, EURSGD. |

| Indices (Spot) | ESTX50, FRA40, GER40, JPY225, NAS100, SPAIN35, SPX500, UK100, US30. |

| Metals (Spot) | XAUUSD, XAGUSD. |

| Oil (Spot) | WTI, BRENT. |

| Digital Currencies | BTCUSD, ETHUSD, BCHUSD, LTCUSD. |

Match-Trader

| Symbols | Instruments |

|---|---|

| Forex | AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDUSD, CADCHF, CADJPY, CHFJPY, EURAUD, EURCAD, EURCHF, EURGBP, EURJPY, EURNOK, EURNZD, EURSEK, EURSGD, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPNZD, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDUSD, USDCAD, USDCHF, USDCNH, USDJPY, USDMXN, USDNOK, USDSEK, USDSGD, USDZAR. |

| Indices | ESTX50, FRA40, GER40, JPN225, SPAN35, UK100, NAS100, US30, SPX500. |

| Commodities | BRENT, WTI, XAGUSD, XAUUSD. |

| Digital Currencies | BCHUSD, BTCUSD, ETHUSD, LTCUSD. |

DXtrade

| Symbols | Instruments |

|---|---|

| Forex | AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDUSD, CADCHF, CADJPY, CHFJPY, EURAUD, EURCAD, EURCHF, EURGBP, EURJPY, EURNOK, EURNZD, EURSEK, EURSGD, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPNZD, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDUSD, USDCAD, USDCHF, USDCNH, USDJPY, USDMXN, USDNOK, USDSEK, USDSGD, USDZAR. |

| Indices | ESTX50, FRA40, GER40, JPN225, SPAN35, UK100, NAS100, US30, SPX500. |

| Metals | XAUUSD, XAGUSD. |

| Oil | WTI, BRENT. |

| Digital Currencies | BCHUSD, BTCUSD, ETHUSD, LTCUSD. |

At the moment, this is only possible in one case: if you have not yet opened a single position in your challenge account. In this case, please contact our support team so that we can change the platform! You can only make this change once per account, and the account number available on the other platform will be permanently deleted when you switch.

Trailing Drawdown (Simplex accounts and Instant Funding)

The Maximum Trailing Drawdown is initially set at a specific % and trails (using CLOSED BALANCE – NOT equity) your account until you have achieved a pre-defined % return in your account. Once you have achieved the % return, the Maximum Trailing Drawdown no longer trails and is permanently locked in at your starting balance.

Example with a 6% trailing drawdown

If your starting balance is $100,000, you can drawdown to $94,000 before you would violate the Maximum Trailing Drawdown rule. Then for example let’s say you take your account to $102,000 in CLOSED BALANCE. This is your new high-water mark, which would mean your new Maximum Trailing Drawdown would be $96,000. Next, let’s say you take your account to $106,000 in CLOSED BALANCE, which would be your new high-water mark. At this point your Maximum Trailing Drawdown would be locked in at your starting balance of $100,000. For example, if you take your account to $120,000 and you have not scaled up, as long as you do not drawdown more than 4% (in Simplex plan) in any given day, you would only breach if your account equity reaches $100,000.

Absolute (Static) Drawdown (Duplex & Triplex accounts)

Absolute drawdown is the maximum your account can drawdown before you would hard breach your account. When you open the account, your Maximum Drawdown is set at a defined % of your starting balance. This % is static and does not trail.

What is the difference between a Hard Breach and Soft Breach rule?

Soft breach means that we will close all trades that have violated the rule. However, you can continue trading in your Assessment or Live Account. Hard breach means that you violated either the Daily Loss Limit or Max Trailing Drawdown rule. Both rules constitute a hard breach. In the event you have a hard breach, you will fail the Assessment or have your Live Account taken away.

You can hold positions over the weekend with Simplex, Duplex, and Triplex accounts and Duplex/Triplex Bonus accounts, but only allowed during the challenge phases, but not in the Funded stage.

In Instant Plan Weekend holding is not allowed.

Hexa Prop permits holding positions over the weekend, but it’s important to consider the associated risks:

Formation of Gaps

Stock exchanges are closed on Saturday and Sunday, so there are no quotes and no trading. However, during these two days, there may be events occuring that could trigger strong reactions on the markets. In such cases, there could be a significant gap at the start of trading on Monday.

If you are lucky, this move will be in the direction of your position, but if not, it could even take the balance over the stop-loss level and into a significant negative floating loss. If such a loss exceeds the allowed, daily loss limit, the system will deactivate the account. Hexa Prop is not able to pay out profits resulting from extreme gaps occurring over the weekend.

How do you calculate the Daily Loss Limit?

The daily loss limit is the maximum your account can lose in a single day. This limit is calculated based on the previous day’s balance and resets at the start of each new trading day. The Daily Stop increases as your account grows.

Example: If your ending balance on the previous day was $100,000, your account would breach the daily loss stop limit if your equity drops to $95,000 at any point during the day. If your floating equity is +$5,000 on a $100,000 account, the new maximum daily loss is still based on your previous day’s balance ($100,000). Therefore, your daily loss limit would remain at $95,000.

The maximum inactivity period should be 30 days, after which the account will be deleted.

In trading, 1 lot is a standard unit of measure that defines the size of a trading position in the forex and other financial markets.

In forex trading:

- 1 lot typically represents 100,000 units of the base currency in a currency pair. For example, if you trade 1 lot on the EUR/USD pair, it means you are buying or selling 100,000 euros against the U.S. dollar.

- 0.1 lot (also called a mini lot) represents 10,000 units of the base currency.

- 0.01 lot (also called a micro lot) represents 1,000 units of the base currency.

The lot size determines the amount of risk and potential profit for a given trade. A larger lot size means greater exposure and higher risk, so profits and losses will be proportionally larger.

Example: If you open a 1 lot position on EUR/USD, it represents a trade worth 100,000 euros. A one-pip movement (the smallest change in price) would result in a $10 change in the position’s value.

What is 1 lot equal to on the Hexa Trading Platforms?

- Forex: 1 lot = $100k notional

- Index: 1 lot = 1 Contract Exceptions: SPX500: 1 lot = 10 contracts JPN225: 1 lot = 500 contracts

- Digital Currency: 1 lot = 1 coin

- Silver: 1 lot = 5000 ounces

- Gold: 1 lot = 100 ounces

- Oil: 1 lot = 100 barrels

The leverage we offer depends on the account type.

Instant: Forex pairs: 1:30; Gold: 1:10; Indices: 1:10; Oil: 1:5; Digital Currencies: 1:1

Simplex: Forex pairs: 1:30; Gold: 1:10; Indices: 1:10; Oil: 1:5; Digital Currencies: 1:1.

Duplex: Forex pairs: 1:50; Gold: 1:10; Indices: 1:20; Oil: 1:5; Digital Currencies: 1:1.

Duplex Double Bonus: Forex pairs: 1:30; Gold: 1:10; Indices: 1:10; Oil: 1:5; Digital Currencies: 1:1

Triplex: Forex pairs: 1:50; Gold: 1:20; Indices: 1:20; Oil: 1:10; Digital Currencies: 1:1.

Triplex Double Bonus: Forex pairs: 1:30; Gold: 1:10; Indices: 1:10; Oil: 1:5; Digital Currencies: 1:1

cTrader (UTC)

Match-Trader (UTC)

DXtrade (UTC+1)

Trading hours are generally set by the Liquidity Provider, unless set by our rules. We do not have any control over the trading hours. You can see the trading hours for each product by using the following methods: DXtrade – Right click symbol, select “Instrument Info” MatchTrader – Click symbol to expand, select “Info” cTrader – Navigate to Symbol Window, scroll down to see “Market Hours” for selected symbol

Hexa Prop permits the use of Expert Advisors (EAs), but it is prohibited to use any EA trading strategy that is specifically banned by the Company or its liquidity providers.

If you wish to use an Expert Advisor, please carefully read our policy on EA usage, which can be found in Challenge Rules & Prohibited Activities.

Upon passing your Assessment, you will receive an email with instructions on how to access and complete both your “Know Your Customer” verification and your “Trader Agreement”. Once both are completed and supporting documentation is provided, your Funded Account will be created, funded and issued to you. You will receive a confirmation email once this account is being enabled.

No. We do not have any control over pricing from the liquidity provider or on the executions on your trades.

The maximum position that you may open is determined by your available margin.

If you have gains in your Funded Account at the time of a hard breach, you will still receive your portion of those gains. For example, if you have a $100,000 account and you grow that account to $110,000. Should you then have a hard breach we would close the account. Of the $10,000 in gains in your Live Account, you would be paid your portion thereof.

Traders can request the withdrawal of profits from their funded accounts at any time through their merchant dashboard.

The first withdrawal can be requested after 14 days, and subsequently every 7 days in Simplex, Duplex, Triplex accounts.

The first withdrawal can be requested after 28 days, and subsequently every 14 days in Duplex/Triplex Bonus accounts.

You can withdraw your profits from day one in Instant account.